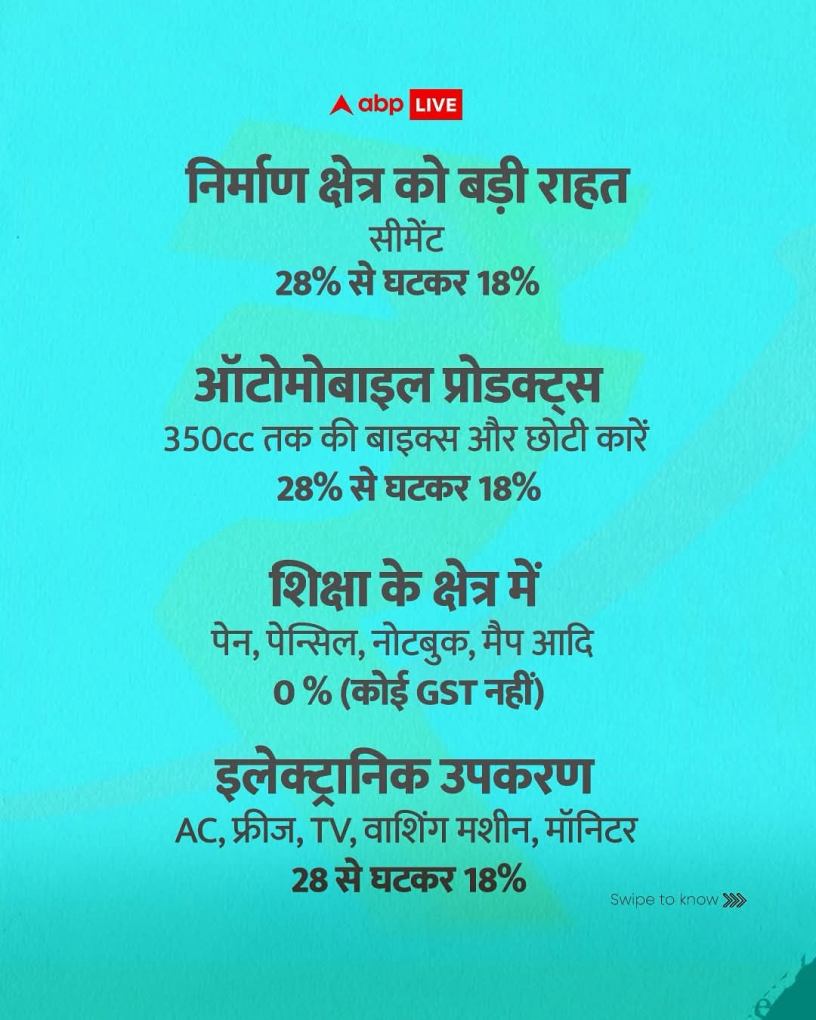

The GST Council has announced major tax cuts across key sectors including construction, automobiles, education, and electronics. This reform will make essential goods and services more affordable, boost industry growth, and ease the financial burden on consumers.

🏗️ Relief for the Construction Sector

- Cement, a crucial material in the real estate and infrastructure sector

👉 GST reduced from 28% to 18%

✅ This will lower construction costs and encourage faster infrastructure development.

🛵 Automobile Products

- Two-wheelers up to 350cc

- Small cars

👉 GST reduced from 28% to 18%

✅ Buyers of budget motorcycles and cars will now save significantly, boosting sales in the auto industry.

📚 Relief in the Education Sector

- Pens, pencils, notebooks, maps, and other essential stationery

👉 Now 0% GST (completely tax-free)

✅ This will make education more affordable for students and reduce costs for families.

💻 Electronics & Home Appliances

- Air Conditioners (ACs)

- Refrigerators

- Televisions

- Washing Machines

- Monitors

👉 GST reduced from 28% to 18%

✅ This reduction will make household electronics more affordable, helping middle-class families upgrade their lifestyle.

🎯 Key Benefits of the GST Cuts

- Lower prices for housing, vehicles, and electronics

- Education costs reduced for students and parents

- Boost for construction and auto industries

- Increased purchasing power for the common man

💡 Conclusion

The GST rate cuts are a game-changer for multiple industries and consumers alike. By lowering taxes on essentials like cement, vehicles, stationery, and electronics, the government is making life easier, while also driving economic growth and affordability.

Discover more from Commercial Account Services

Subscribe to get the latest posts sent to your email.